Introducing

Scratch Checkout

How we stack up

|

|

|

|---|---|---|

| Patient financing at checkout | ||

| Integrated with leading practice management software (PIMs) | ||

| Digital and in-person payment options | ||

| Automated AR collections |

Questions? Schedule a 30 Minute Overview

Payment Processing

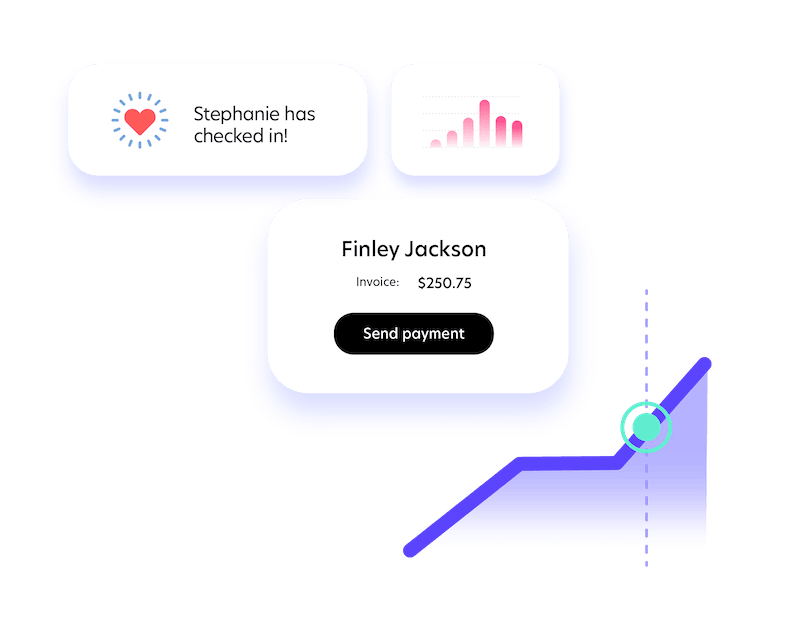

From check-in to checkout

Simplify billing & collections with Scratch

Payment Processing

From check-in to checkout

Simplify billing & collections with Scratch

No setup costs | No cancellation fees

Simple Practice Management Systems Workflows

The ultimate in simplicity.

Scratch links our payment processing technology seamlessly with the leading practice management software.

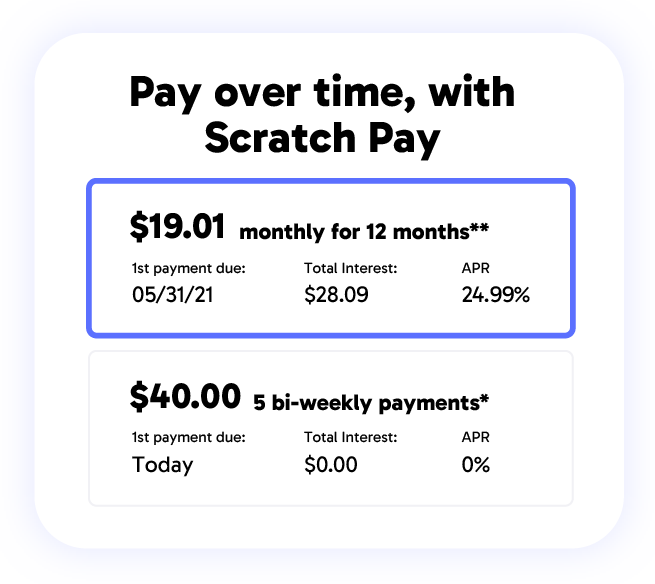

Simplify and save with the Scratch Checkout

Innovative, Integrated Payment Processing at competitive rates. See how you can streamline your hospital and save $900 per month.†

†Average monthly savings on fees for practices that switched to Scratch Checkout in 12 months ending 11/1/2023.

-trimmy.png)